The Definitive Guide to Stages Of Team Development (Tuckman) – 12manage

: The technicians of intergroup communication, decision-making, and accountability are set and also handled successfully. Nearly all groups do not have one or more of these standards at some point in their period. Team development makes every effort to fulfill these standards with ongoing representation as well as growth. Like any type of type of growth, it requires time and commitment to be effective.

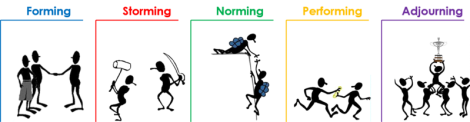

As the real work starts, the job might provide both technical as well as interpersonal obstacles. Private job behaviors, management decisions, or gaps in communication can cause tension within a group. Inconvenience, disappointment, as well as stress and anxiety generally occur in feedback. This phase of team development is called storming. Storming is one of the most tough as well as unsuccessful of the five phases of growth, but it is nevertheless important to the team development process.

With this info, the group can start striving to a better team dynamic. The norming stage of team development is the calmness after the tornado. In this phase of team development, staff member come under a rhythm as a natural taskforce. The abilities of each participant are verified as well as made use of to implement the necessary tasks.

6 Easy Facts About Team Development And Dynamics – Uw Hr – University Of … Explained

The team can manage conflict as well as wage the task efficiently. Some teams get to a phase of advancement in which they grow at their individual and also cumulative jobs. The abilities of each member are completely enhanced, guidance is virtually never required, and members really feel a strong feeling of count on each other.

Reaching the executing stage is a major success as well as usually precipitates some kind of team discovering. Team learning is a behavioral process of looking for, event, going over, and also carrying out methods of team success. Whether with training, group effort, or ingenious management, team understanding is an activity step that ensures healthy and balanced team development.

Knowing Outcomes Define the five stages of team development. Explain exactly how team norms and cohesiveness influence efficiency. Intro Our discussion until now has actually concentrated mostly on a group as an entity, out the people inside the team. This resembles explaining an auto by its design and also color without considering what is under the hood.

7 Easy Facts About The Five Behaviors® Team Development – Disc Profile Explained

In teams, the internal attributes are individuals in the group as well as exactly how they communicate with each other. For teams to be reliable, individuals in the team have to have the ability to collaborate to add collectively to group outcomes. This does not happen immediately: it develops as the team works together.

Stages of Team Development This procedure of finding out to collaborate properly is referred to as team development. Research study has revealed that groups experience definitive phases during advancement. Bruce Tuckman, an academic psychologist, determined a five-stage growth process that the majority of teams follow to come to be high doing. He called the phases: creating, storming, norming, doing, and adjourning. improve employee retention.

A lot of high-performing teams go with five stages of team development. Creating stage The developing phase involves a duration of orientation and getting acquainted. Unpredictability is high during this stage, as well as individuals are trying to find leadership and authority. platform. A participant that insists authority or is experienced may be sought to take control.

The Definitive Guide for 5 Stages Of Group Development .Doc

Group efficiency increases throughout this phase as participants discover to coordinate and start to concentrate on group objectives. The consistency is perilous, as well as if disagreements re-emerge the group can move back right into storming. In the performing stage, agreement and also teamwork have been reputable and the team is mature, organized, as well as well-functioning.

Team development programs by Turnkey Coaching Solutions

Issues and also problems still emerge, but they are handled constructively. (We will discuss the role of problem and dispute resolution in the next area). The group is focused on issue addressing as well as fulfilling group goals. In the adjourning phase, a lot of the group`s objectives have been accomplished. The emphasis is on wrapping up last tasks and documenting the initiative as well as results.

There might be regret as the group finishes, so a ritualistic recognition of the work as well as success of the team can be handy. If the group is a standing board with ongoing duty, participants might be replaced by brand-new people as well as the group can return to a forming or storming phase and also repeat the advancement procedure.

The Definitive Guide to Team Development – Cleveland Consulting Group, Inc.

Group standards established a criterion for behavior, mindset, and also performance that all employee are anticipated to comply with. Norms resemble guidelines however they are not listed. Rather, all the team participants unconditionally recognize them. Standards work because group members wish to sustain the team and protect relationships in the team, and also when norms are breached, there is peer pressure or sanctions to implement compliance.

The Definitive Guide for What Is Team Development And Its 5 Stages [Explained]

The Definitive Guide for What Is Team Development And Its 5 Stages [Explained]

Originally, during the creating as well as storming phases, norms focus on assumptions for participation as well as dedication. Later on, throughout the norming and executing stages, norms focus on partnerships as well as degrees of performance. Performance standards are really essential because they specify the degree of job effort and requirements that identify the success of the team.

Standards are only reliable in controlling actions when they are accepted by staff member. The level of on the group mostly figures out whether employee accept as well as adapt norms. Group cohesiveness is the extent that members are brought in to the group and are motivated to continue to be in the group. employee engagement.

Facts About 8. Progress Through The Stages Of Team Development Revealed?

They attempt to satisfy norms because they intend to preserve their connections in the team as well as they desire to meet team assumptions. Groups with solid efficiency standards and high cohesiveness are high executing. As an example, the seven-member executive group at Whole Foods spends time with each other beyond job. Its members often interact socially and also take group holidays.

You don`t need to get superpowers from a lotion or produce among one of the most iconic brands of your generation to be a fantastic leader. Overview your team through each stage of the process with the adhering to ideas:1. Establish a clear objective and also mission and also revisit it throughout the process.

It is the framework that will assist you make decisions. It offers you instructions. Without it, you`ll go no place. Individuals obtain so lost in a specific job that they forget why they are doing it in the first area. It is very easy to shed view of the “broad view”. Groups need a clear objective and objective and must be advised of them usually.

More About How To Build A Growth Team – Lessons From Uber, Hubspot …

Establish ground rules and make sure they are followed. Regulations might not seem enjoyable, yet they remove up complication. Without them, no one will certainly understand what is considered appropriate actions. Everybody will certainly have their very own “design” of doing points. Teams without regulations are disjointed, vulnerable to conflict and inefficient. One of the first tasks that teams need to do is develop ground regulations.

Some examples are:Read more here: turnkeycoachingsolutions.com Don`t interrupt another participant when they are talking. Turn off your phone throughout working meetings. Track your time transparently with Toggl Track. Produce a weekly job strategy with tasks and share it with the group. Bear in mind that guidelines are produced to help your group remain concentrated on what matters mostperformance.

Unleash The Power Of Teamwork - Online Team Development Demo

Let various other participants serve as leaders or facilitators. Every team must have a facilitatora individual who leads and also guides conferences and also discussions. Someone who drives the team towards an usual objective. As a firm founder or supervisor, you might be the designated team leader. That doess not indicate you must always be the one leading.