Team Development Interventions: Evidence-based … assistance?

: The auto mechanics of intergroup communication, decision-making, as well as responsibility are agreed upon and handled effectively. Nearly all groups do not have one or more of these criteria at some time in their period. Team development strives to satisfy these standards with ongoing representation and also growth. Like any type of type of growth, it requires time and devotion to be effective.

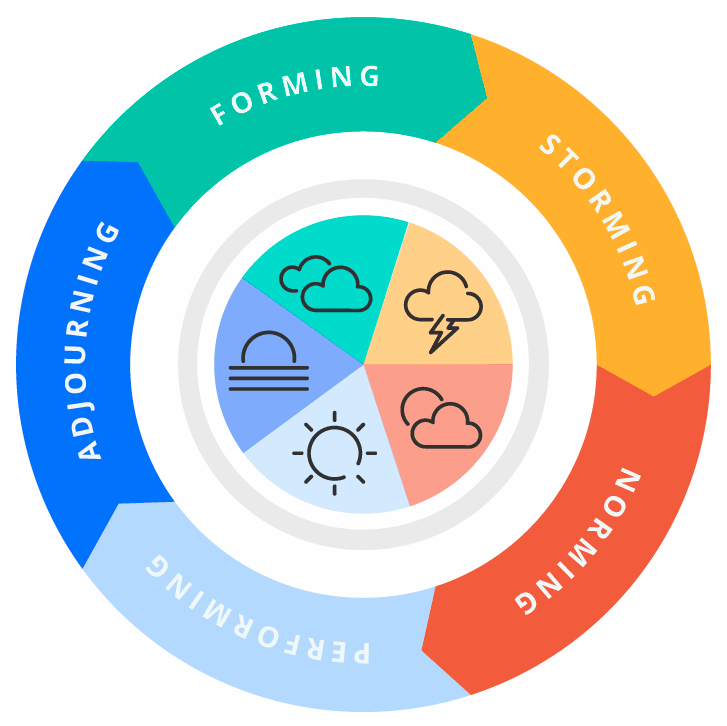

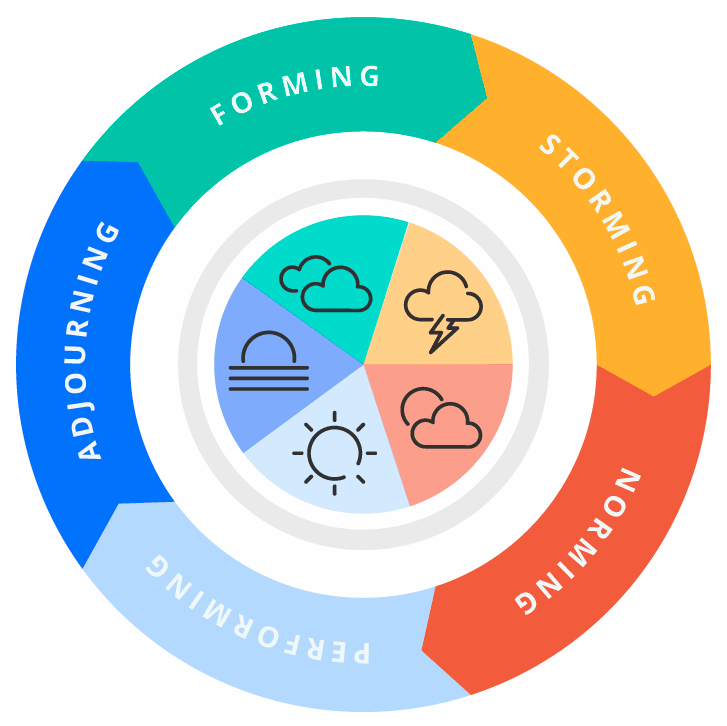

As the actual job kicks in, the job may present both technological and also interpersonal challenges. Individual work practices, leadership decisions, or gaps in interaction can create stress within a group. Annoyance, frustration, and also stress and anxiety commonly arise in feedback. This stage of team development is known as storming. Storming is the most challenging and unproductive of the five stages of development, yet it is however important to the team development procedure.

With this information, the team can start aspiring to a much better group dynamic. The norming stage of team development is the calm after the storm. In this stage of team development, employee fall under a rhythm as a cohesive taskforce. The skills of each member are verified as well as made use of to carry out the essential jobs.

The Ultimate Guide To Team Development Over Time – Organizational Behavior?

The team can take care of problem and also wage the job effectively. Some groups reach a phase of advancement in which they thrive at their private and collective tasks. The skills of each participant are totally maximized, guidance is virtually never required, as well as members really feel a strong feeling of count on in each other.

Reaching the performing stage is a major success as well as usually speeds up some kind of team understanding. Group learning is a behavioral procedure of looking for, gathering, discussing, as well as applying approaches of group success. Whether via training, group effort, or ingenious leadership, group knowing is an action step that makes certain healthy team development.

Discovering Outcomes Explain the five stages of team development. Explain how group standards and also cohesiveness influence efficiency. Introduction Our conversation so much has actually concentrated primarily on a team as an entity, not on the individuals inside the team. This is like explaining a car by its model and also color without considering what is under the hood.

The Only Guide to Tuckman`s Team Development Model – Bright Morning

In groups, the internal features are individuals in the group and also exactly how they connect with each other. For groups to be efficient, the people in the team need to be able to interact to contribute jointly to group outcomes. Yet this does not happen instantly: it establishes as the group interacts.

Phases of Team Development This procedure of finding out to function together properly is known as team development. Research has actually shown that teams undergo definitive phases throughout development. Bruce Tuckman, an academic psycho therapist, recognized a five-stage growth process that many teams comply with to come to be high executing. He called the phases: forming, storming, norming, carrying out, and also adjourning. platform.

Most high-performing teams go with five stages of team development. Forming stage The developing phase includes a duration of positioning as well as obtaining familiarized. Unpredictability is high during this stage, as well as people are looking for management and authority. artificial intelligence. A participant who asserts authority or is educated may be sought to take control.

The Only Guide to Team Building Activities: Forming In The Forming Stage, Group …

Group efficiency enhances during this phase as participants learn to work together as well as start to concentrate on team goals. However, the consistency is precarious, as well as if disputes re-emerge the team can relapse into storming. In the executing stage, agreement and also cooperation have actually been well-established and also the team is mature, arranged, as well as well-functioning.

Build a team that builds success

Problems and also conflicts still emerge, however they are taken care of constructively. (We will review the role of dispute and conflict resolution in the next area). The group is focused on problem fixing as well as meeting group goals. In the adjourning stage, the majority of the team`s goals have actually been achieved. The emphasis is on finishing up final tasks and recording the effort as well as results.

There may be remorse as the team ends, so a ritualistic recognition of the work and success of the group can be useful. If the team is a standing committee with recurring obligation, members might be changed by new individuals as well as the team can return to a developing or storming stage and repeat the advancement process.

Some Known Factual Statements About 4.2 Five Models For Understanding Team Dynamics ?

Team norms set a requirement for habits, perspective, and also efficiency that all employee are expected to comply with. Standards are like guidelines yet they are not listed. Instead, all the group participants implicitly understand them. Standards are efficient since staff member wish to sustain the group as well as protect partnerships in the team, as well as when norms are breached, there is peer stress or permissions to enforce compliance.

What Does Why Is Team Development Important To A Leader? – Cmo … Mean?

What Does Why Is Team Development Important To A Leader? – Cmo … Mean?

During the developing and also storming stages, standards concentrate on expectations for attendance as well as commitment. Later on, during the norming and also executing phases, standards focus on partnerships as well as levels of efficiency. Performance standards are really crucial because they define the level of job initiative and criteria that figure out the success of the team.

Standards are only efficient in regulating actions when they are approved by team members. The level of on the group primarily identifies whether employee approve and adapt to standards. Team cohesiveness is the extent that participants are drawn in to the group as well as are inspired to continue to be in the team. improve employee retention.

See This Report on Team Development – Ey Uk

They attempt to satisfy standards due to the fact that they want to preserve their relationships in the group as well as they wish to meet group expectations. Groups with strong performance norms and also high cohesiveness are high doing. The seven-member exec team at Whole Foods spends time together outside of work. Its participants often socialize and also take team holidays.

You don`t need to obtain superpowers from a product or create one of the most legendary brands of your generation to be a wonderful leader. Overview your team via each stage of the procedure with the following pointers:1. Establish a clear function as well as goal and also review it throughout the procedure.

It is the structure that will certainly assist you make choices. It offers you instructions. Without it, you`ll go no place. Individuals obtain so shed in a specific job that they forget why they are doing it in the initial area. It is very easy to shed sight of the “broad view”. Groups need a clear objective as well as mission as well as should be reminded of them commonly.

Examine This Report on Leadership And Team Development For Managerial Success

Set guideline and also make certain they are followed. Rules might not seem fun, however they clean up confusion. Without them, no person will understand what is considered acceptable actions. Every person will certainly have their own “design” of doing things. Groups without regulations are disjointed, susceptible to conflict and inefficient. One of the very first jobs that teams should do is develop ground regulations.

Some instances are:turnkeycoachingsolutions.com Don`t interrupt another member when they are talking. Transform off your phone throughout functioning conferences. Track your time transparently with Toggl Track. Create a regular work strategy with tasks as well as share it with the group. Keep in mind that rules are produced to help your group remain concentrated on what matters mostperformance.

What it takes to build a cohesive team?

Allow other members function as leaders or facilitators. Every team ought to have a facilitatora person that leads as well as overviews conferences as well as discussions. Someone who drives the team in the direction of a typical goal. As a business owner or manager, you may be the marked group leader. However, that does not indicate you ought to always be the one leading.